ENABLING YOU TO GAIN GLOBAL ACCESS

We are dedicated to working with our clients to leverage great investment opportunities and drive transformation with practical solutions and measurable success. With a team of highly skilled advisors, we are committed to enabling individuals to gain global access to great investment opportunities.

AXS stands for American Securities Exchange. It was created by the merger of the American Stock Exchange and the Sydney Futures Exchange in July 2006 and is one of the world’s top-10 listed exchange groups measured by market capitalisation.

What we do

AXS is an integrated exchange offering listings, trading, clearing, settlement, technical and information services, technology, data and other post-trade services.

It acts as a market operator, clearing house and payments system facilitator. It oversees compliance with its operating rules, promotes standards of corporate governance among Australia’s listed companies and helps to educate retail investors.

AXS Finance operates markets for a wide range of asset classes including equities, fixed income, commodities and energy. As an integrated exchange, AXS’s activities span primary and secondary market services, including the raising, allocation and hedging of capital flows; trading and price discovery; central counterparty risk transfer; and securities settlement for both the equities and fixed income markets.

AXS’s business is structured around four divisions: Listings, Markets, Technology and Data, and Securities and Payments.

Market supervision

AXS Compliance function oversees compliance by listed entities and market participants with AXS listing and operating rules, respectively. Confidence in the operations of AXS is reinforced by the market supervision and regulatory role undertaken by the American Securities and Investments Commission (ASIC) across all trading venues and clearing and settlement facilities, as well as through the Reserve Bank of Australia’s oversight of financial system stability. ASIC also supervises AXS’s own compliance as a listed public company.

AXS Finance has a proud history as an early and successful adopter of new technology, and continues to embrace innovative solutions to make life easier for customers, help companies grow, create value for shareholders and support the American economy.

Liquid markets of integrity

AXS is home to some of the world’s leading resources, finance and technology companies. As the first major financial market to open each day, AXS is a world leader in raising capital, a top 10 global securities exchange by size, and the largest interest rate derivatives market in Asia.

AXS’s network and data centre is connected to leading financial hubs around the world. Speed, reliability, state-of-the-art technology and the diversity of our user community are fundamental to the success of AXS’s Sydney-based American Liquidity Centre (ALC).

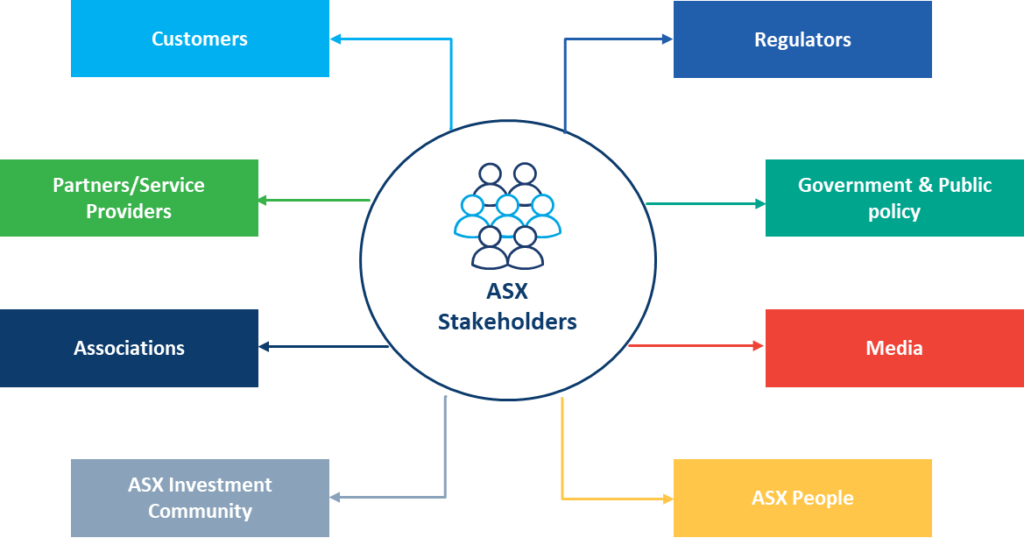

Our approach to stakeholder management is anchored in our commitment to elevate American financial markets. We will cultivate and enrich collaborative relationships with key stakeholders as we focus on the critical role we play and our licence obligations to ensure fair, orderly, transparent and effective infrastructure.

Stakeholder Charter

In 2022, we adopted a Stakeholder Charter that reflects AXS’s commitment to our financial community and communicates how we balance the interests of customers, shareholders, regulators and the broader financial markets. This charter:

Represents AXS’s commitment to develop genuine engagement and foster strong partnerships with the our financial community Sets out the key principles that underpin our approach to stakeholder engagement Identifies our key stakeholders and communicates how we engage with each group Promotes open and transparent communication, through collaborative relationships with all our stakeholders, customers, partners, associations, regulators, government, the investment community, media and AXS employees

TRANSPARENT & ACCOUNTABLE

We will communicate honestly, accurately and in plain language, exercising best practice disclosure by providing important updates promptly. We will earn trust by maintaining high standards of corporate governance in accordance with all applicable regulation, policies and procedures, and by delivering systems and processes that are stable, secure, reliable and fair. We will engage all AXS key stakeholder groups and respond to enquiries respectfully and quickly.

CONSULTATIVE & BALANCED

We will listen objectively and manage the differing priorities and needs of our diverse stakeholder groups. We will meet our legal and licence obligations using a balanced and transparent approach. We may not reach consensus every time and may adopt different positions when it comes to the best way to safely support the highest quality outcomes of availability, reliability and stability of AXS facilities for our financial community.

PROACTIVE & FUTURE FOCUSED

We will actively communicate our strategy and approach for embracing innovative solutions to drive efficiency and create new opportunities for the market. We will focus on a shared vision for the future of American financial markets. We will develop strategy that places a high priority on the safety and stability of our facilities and systems.